Printable 1041 Tax Form for 2023

Federal Tax Form 1041 Instructions for U.S. Estates

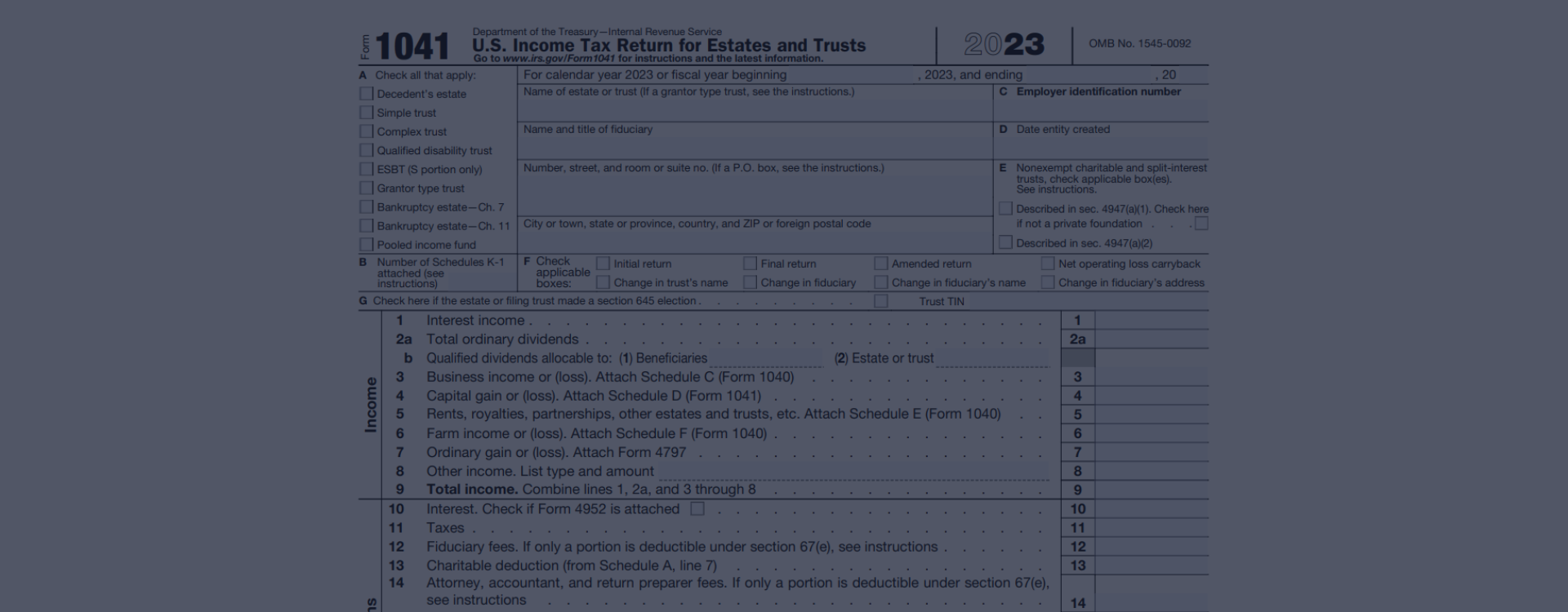

IRS tax form 1041 is an essential document for estates and trusts in the United States, as it is utilized to report income, deductions, gains, and losses. The federal income tax form 1041 must be filed by fiduciaries, such as executors or trustees, who are responsible for administering the financial affairs of estates and trusts. The purpose of Form 1041 is to determine the income fiscal liability of estates and trusts, ensuring that the appropriate tax payments are made according to the Internal Revenue Service (IRS) guidelines.

Generally speaking, there are three main tasks IRS tax form 1041 printable do about which you should know.

The website 1041-form-printable.com offers valuable resources to individuals who are required to fill out IRS Form 1041. By providing comprehensive instructions and examples, the website ensures that users have access to the necessary information to complete the 2023 1041 form printable or fillable accurately. Additionally, the materials available on the site can help clarify complex tax concepts, enabling users to navigate the intricacies of estate and trust taxation with confidence. Utilizing the resources provided by 1041-form-printable.com can significantly simplify the process of filing IRS Form 1041, ensuring that fiduciaries fulfill their tax obligations accurately and efficiently.

IRS Form 1041 & Its Importance for U.S. Estates and Trusts

The IRS 1041 form for 2023 is a tax document that must be filed by trustees, such as executors or administrators, managing estates or trusts generating income. This form is essential for reporting income, deductions, and credits associated with these entities and ensuring proper tax compliance.

Imagine, for example, a woman named Jane Doe, who recently became the executor of her late father's estate. Jane is responsible for managing her father's assets and distributing them to his beneficiaries according to his will. In the process, the estate generates income from investments and rental properties. In this situation, Jane would need to file 1041 online or via mail to report the estate's income and expenses to the IRS.

To assist Jane in preparing the IRS Form 1041 printable for 2023, she can visit our website to download a relevant template and check out the newest instructions. Besides, the Form 1041 sample on our website will guide her on completing the blank template accurately, ensuring that she submits the correct information and maintains compliance with tax laws. By diligently filing the IRS 1041 form for her father's estate, Jane can confidently fulfill her fiduciary duties.

Due Date

The due date to file IRS Form 1041 printable in 2023, is April 18th. Failure to submit this form on time can result in penalties from the Internal Revenue Service. Specifically, late filing can lead to a 5% monthly penalty of unpaid tax, up to a maximum of 25%. Additionally, providing false information on the form can result in severe consequences, including fines and potential criminal charges. Ensure accuracy and timeliness when print IRS Form 1041 and complete to avoid these penalties and maintain compliance with tax regulations.

Printable Form 1041 for 2023: Steps to Fill It Out

Filling out the printable 1041 tax form for 2023 can be a daunting task, but with attention to detail and proper guidance, you can avoid errors and ensure accuracy. This guide will help you understand the necessary information to include when completing the printable Form 1041 for 2022 or a fillable template.

Ways to File Form 1041 to the IRS

Filing Form 1041, U.S. Income Tax Return for Estates and Trusts can be done in two main ways: submitting a paper version or utilizing an online filing service. The online filing offers several benefits that may outweigh the advantages of the printable version. Electronic submission of federal tax form 1041 reduces the risk of errors as it typically includes built-in validation tools and automatic calculations. Moreover, online filing provides quicker processing times, ensuring that potential refunds are received more promptly.

On the other hand, the printable 1041 tax form has several advantages, including the ability to review and double-check the information before submission physically. Additionally, it allows for greater flexibility in completing the form at your own pace and the opportunity to consult with a tax professional if needed. There is no need to have an Internet connection or be scared of scams and stolen private data.

Federal Tax Form 1041: More Essential Details for Estates & Trusts

2024 Form 1041 Instructions

Please Note

This website (1041-form-printable.com) is not an official representative, creator or developer of this application, game, or product. All the copyrighted materials belong to their respective owners. All the content on this website is used for educational and informative purposes only.