Form 1041 Download

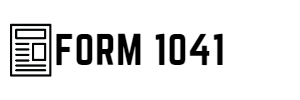

When it comes to dealing with the financial responsibilities of an estate or trust, filing the federal tax form 1041 is a crucial aspect. This form, also known as the U.S. Income Tax Return for Estates and Trusts, is used by fiduciaries to report income, deductions, gains, and losses of estates and trusts. Moreover, it ensures that the estate or trust complies with the Internal Revenue Service (IRS) requirements.

Steps to Obtain and Complete IRS Form 1041

To file form 1041, you must first obtain the printable tax form 1041 which is available on our website. Download the PDF, along with its instructions, and gather all the necessary financial information. Here is a step-by-step guide on how to fill out IRS Form 1041 accurately:

- Begin by providing the basic information about the estate or trust, such as its name, employer identification number (EIN), and address.

- Indicate the type of entity (estate or trust) and check the appropriate boxes for the financial year, accounting method, and other applicable selections.

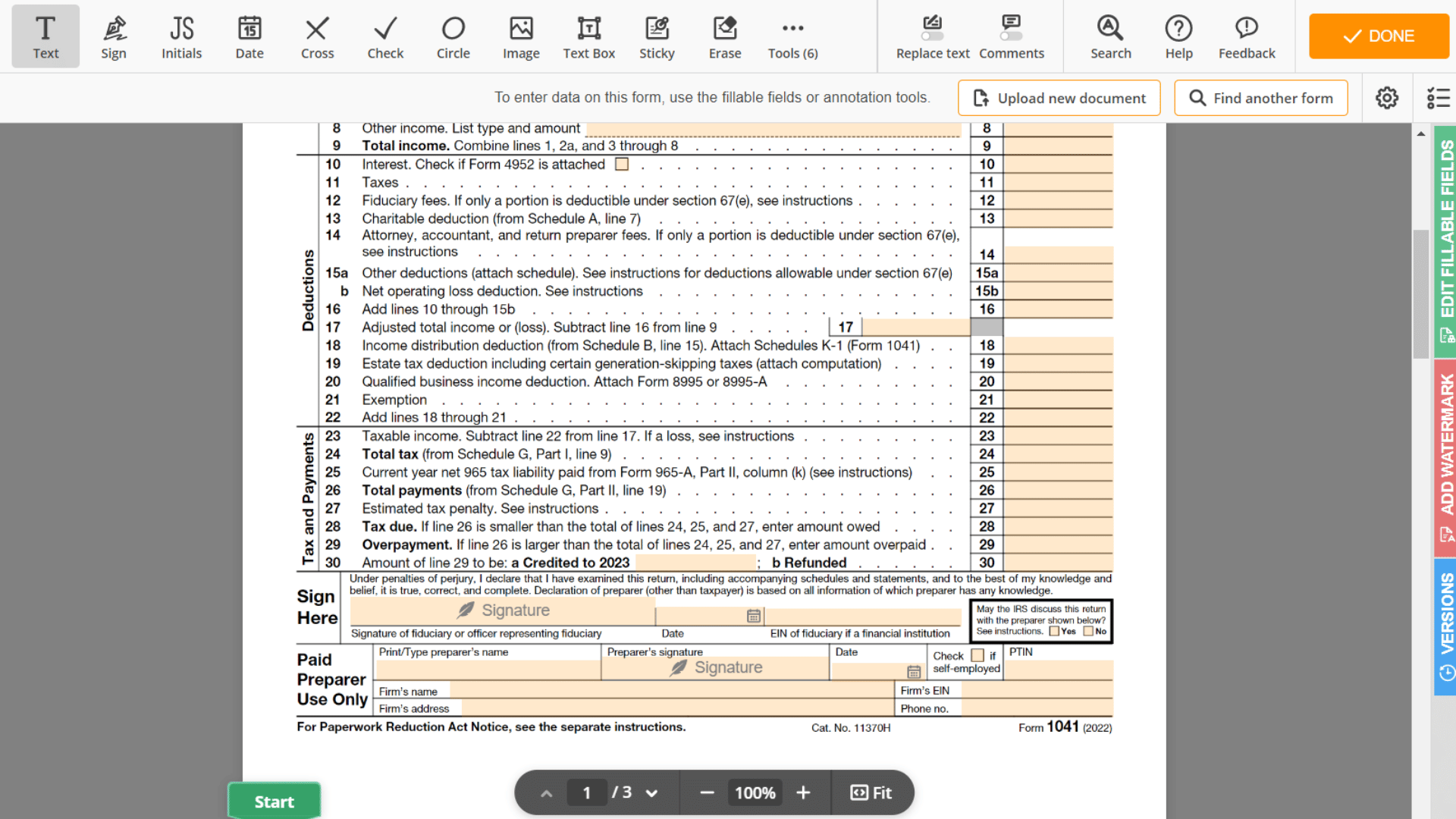

- Report the income of the estate or trust in the Income section, including interest, dividends, capital gains, and other types of income.

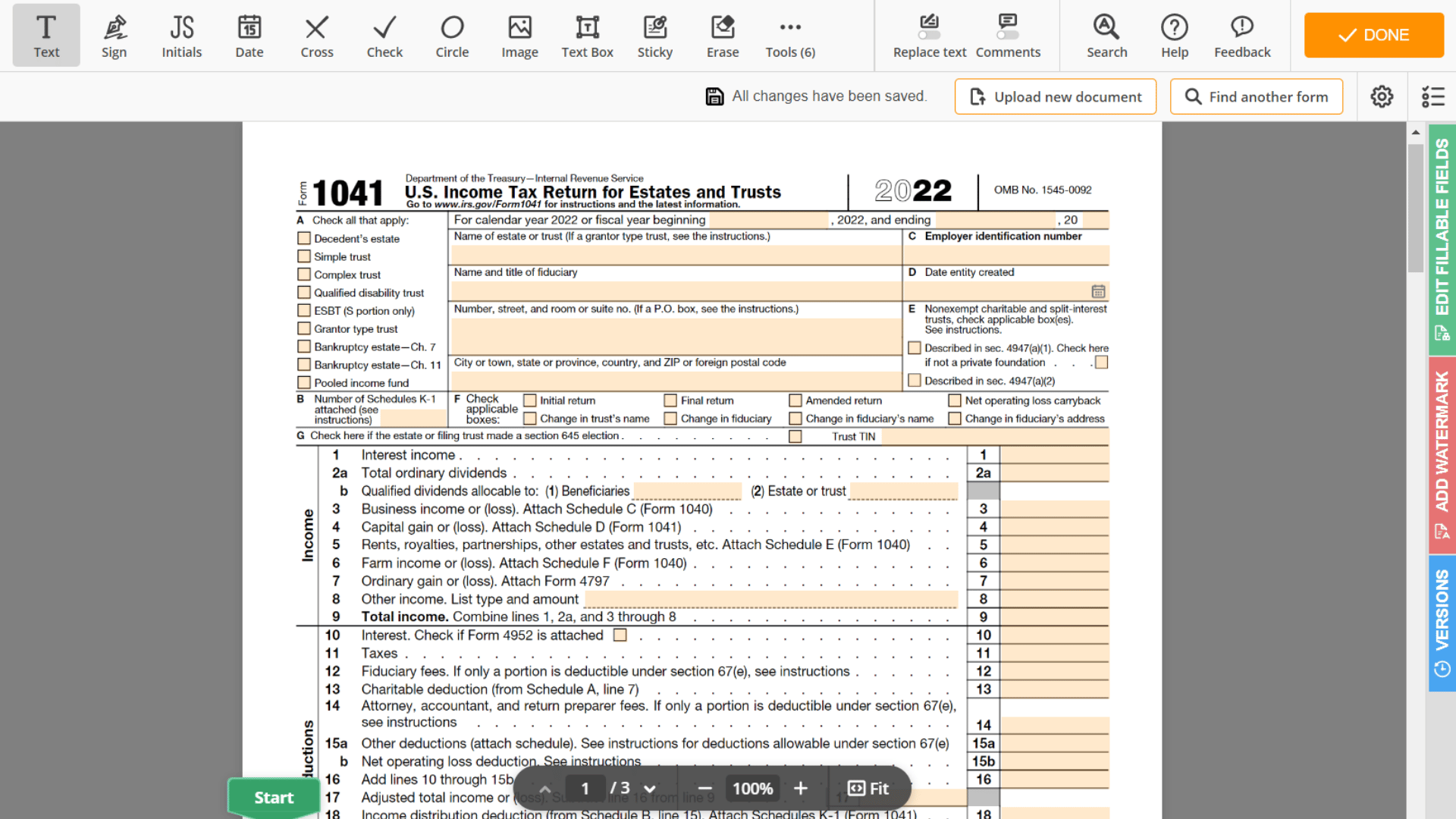

- Enter the appropriate deductions for the estate or trust in the Deductions section. Some common deductions include fiduciary fees, attorney fees, and taxes paid.

- Calculate the taxable income by subtracting the total deductions from the total income.

- Determine the financial liability using the tax rate schedules provided in the Form 1041 instructions, and enter any applicable credits or payments to calculate the total tax due or refund.

- Sign and date the federal 1041 form, and provide the fiduciary's contact information.

Once 2023 IRS Form 1041 is completed, file it by the due date, which is typically April 15th of the year following the year being reported. If needed, you can request an extension by filing Form 7004.

Common Mistakes to Avoid When Completing IRS Form 1041

- Using the wrong fiscal year or entity type

- Forgetting to include the estate or trust's EIN

- Omitting or incorrectly reporting income and deductions

- Calculating the tax liability incorrectly

- Not signing and dating IRS Form 1041

- Failing to file by the due date, or not requesting an extension if needed

Penalties Associated with Filing Errors or Fraudulent Information

Failing to file Form 1041 on time or providing inaccurate or fraudulent data on the sample can result in various penalties. Some of these include:

- A penalty of 5% of the unpaid due for each month or part of a month the return is late, up to a maximum of 25%.

- If the IRS determines that the underpayment of tax is due to negligence or disregard of rules, a 20% penalty on the underpayment amount may be imposed.

- In cases of fraudulent underpayment or false information, the penalty can be as high as 75% of the underpayment amount.